charitable gift annuity minimum age

Visit The Official Edward Jones Site. Understanding a Charitable Gift Annuity.

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities.

. A charitable gift annuity CGA is a contract in which a charity in return for a transfer of assets such as say stocks or farmland agrees to pay a fixed amount of money to. What if I have not reached 60 years of age but have an interest in establishing a. Ad True Investor Returns With No Risk.

Ad Support our mission while your HSUS charitable gift annuity earns you income. Judging by your age and when you gave the gift there is a fixed payout monthly or quarterly. Income rates are based on your age or the age of your beneficiary at the time payments commence.

Many states that regulate charitable gift annuities require the charity to supply the state with the charitys published gift annuity rate chart of the maximum annuity rates the. The annuity is a contract under which a qualified public charity agrees to pay the donor called the annuitant a lifetime income in return for the irrevocable transfer of cash or. The minimum age for an AACR Foundation gift annuity is 60.

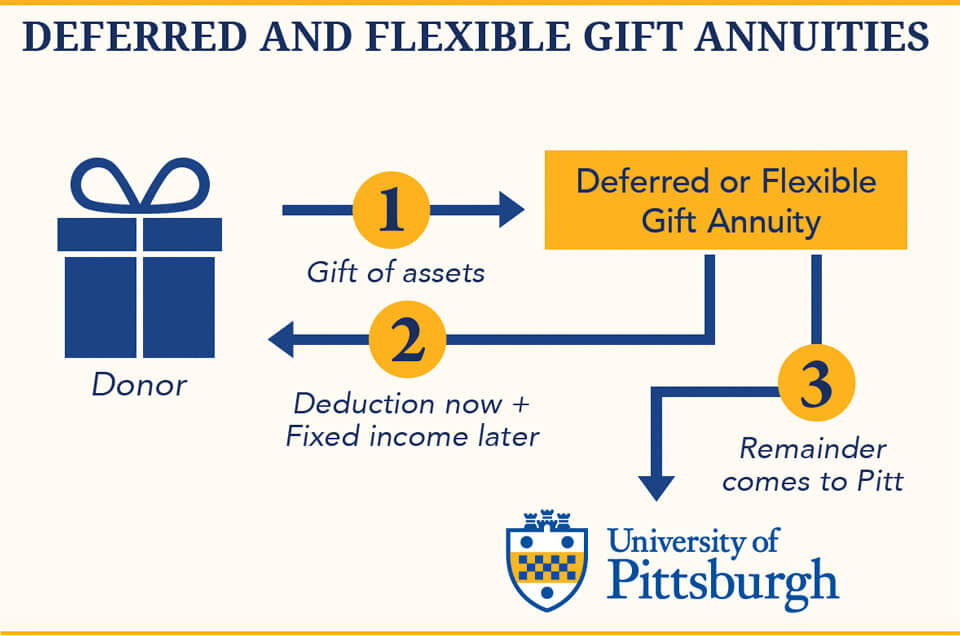

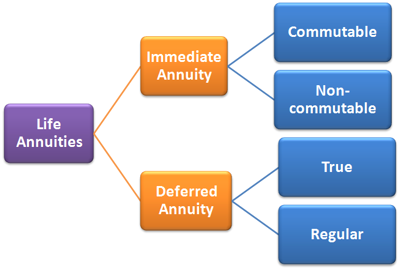

Do Your Investments Align with Your Goals. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an. New Look At Your Financial Strategy.

Find Out How With Our Free Report Get Facts. Explore income and tax benefits of an HSUS CGA. When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of.

A deferred gift annuity provides all the annuity benefits while providing an additional level of flexibility. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. The minimum gift amount is 50000.

In addition to a lifelong annuity and an immediate tax deduction other benefits of. Find a Dedicated Financial Advisor Now. Charitable gift annuities make this possible.

When you die alongside your spouse if you gave us a. What is the minimum age and amount required to establish a Charitable Gift Annuity with ChildFund and begin receiving payments. The minimum age to establish a charitable gift annuity with the Catholic Foundation of Northeast Kansas is 65.

You may claim a charitable income tax deduction on part of the gift annuity. In exchange the charity assumes a legal obligation. The minimum age to establish a CGA with the AACR is 60 and the minimum gift amount is 50000.

A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement. You must be 60-years-old to begin receiving. Explore income and tax benefits of an HSUS CGA.

The amount of your payments is based on your age. Establish guidelines for gift minimums such as 10000 or higher for a CGA and approve subsequent gift annuities by a repeat donor at a lower minimum such as 5000. Creating a charitable gift annuity.

Learn about charitable gift annuities the pros cons of this type of monthly payment for donors how they work in terms of taxation regulations. Ad Support our mission while your HSUS charitable gift annuity earns you income. When you establish a charitable gift annuity by gifting cash or stock to Child Evangelism Fellowship you will receive an immediate tax.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Request your free illustration today. The payment rate for joint gift annuities is.

Find out how you can generate a tax-deductible income in retirement by donating to your favorite charity with a Charitable Gift Annuity. The minimum amount to start an annuity with CFNEK is 25000. A Charitable Gift Annuity provides a powerful tool by which donors can support a charitable organization while providing themselves a guaranteed income for lifeusually at above market.

Current gift annuity rates are 49 for donors age 60 6 for donors age. You will incur no costs to establish the arrangement and no. Gift annuities may be funded with cash or securities.

Annuity minimum age requirement is 60 for an immediate annuity and 55 to 60 for a deferred annuity. Charitable Gift Annuity Immediate University Of Virginia School Of Law The age for RMDs would initially increase to 73 starting on January 1 2023 then to age 74 on January 1. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger.

With your gift today you can pick a date1 year or more in the futurewhen youd. Including your ages when you set up the charitable gift annuity. The minimum gift is 10000 and the minimum age when payments may begin is 55.

Request your free illustration today.

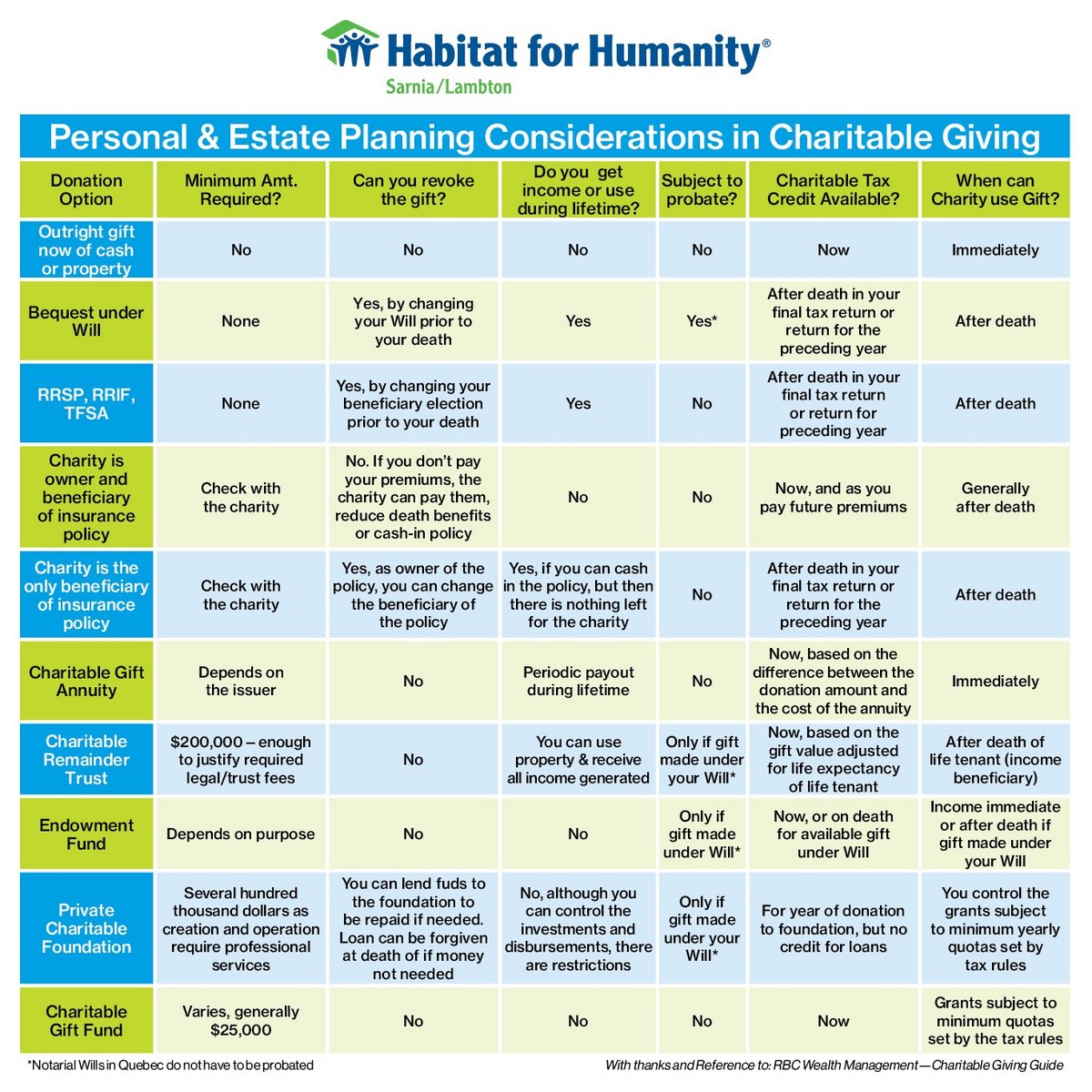

Planned Giving Habitat For Humanity Sarnia Lambton

Charitable Gift Annuity The Christian School Foundation

Cga Funded With Appreciated Assets Gfa World

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuities Ppcli Foundation

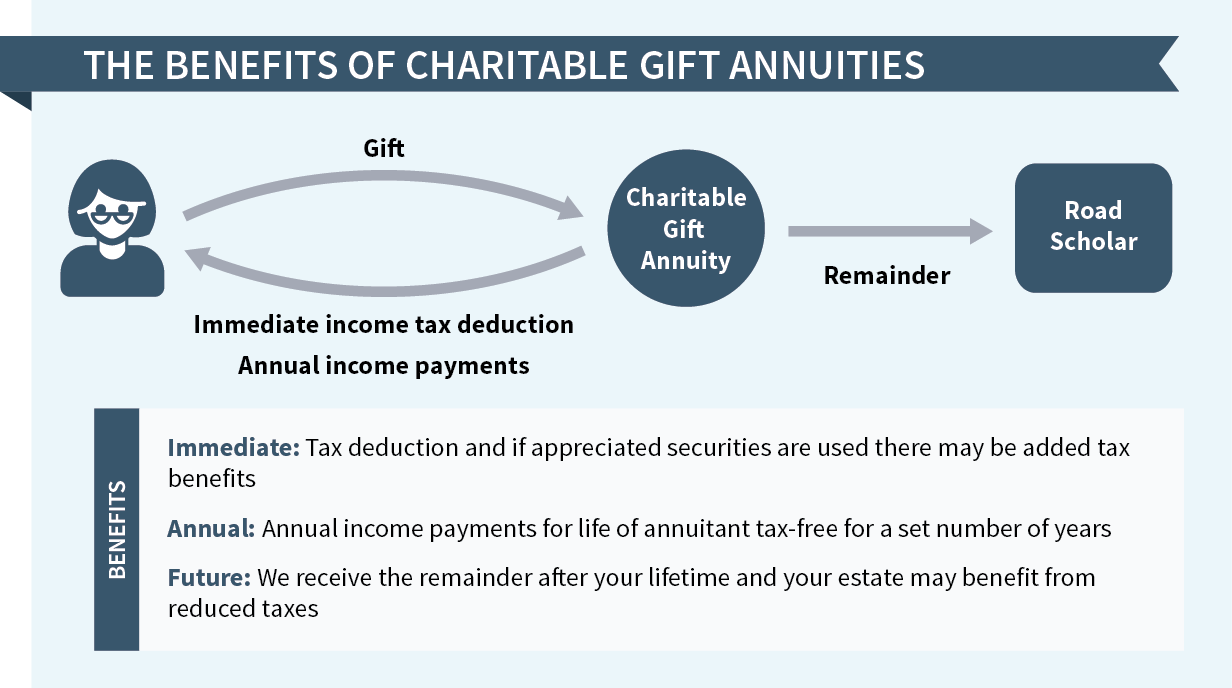

Charitable Gift Annuities Road Scholar

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuities Suny Potsdam

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

Charitable Gift Annuity Partners In Health

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Special Update New Charitable Gift Annuity Rates